Don’t Get Your Popcorn There’s Little Drama in this Data

October 31, 2025

Enthusiasm is common. Endurance is rare.

—Angela Duckworth

Markets have stayed calm as we enter the final stretch of the year. Stocks are steady, volatility is low, and bonds have regained momentum — a combination that can make it easy to relax. But calm is not the same as certain.

Even in stable markets, trends evolve beneath the surface. Our investing process is designed to track those shifts in real time, without assuming today’s conditions will hold tomorrow. That balance — participating in prevailing strength while staying prepared for change — is what allows compounding to continue through both calm and turbulence.

Patience doesn’t mean passivity. It means staying alert, systematic, and grounded when there’s little drama in the data. This month’s Note looks at how markets maintained their composure through October and why true stability in investing comes not from the environment, but from discipline.

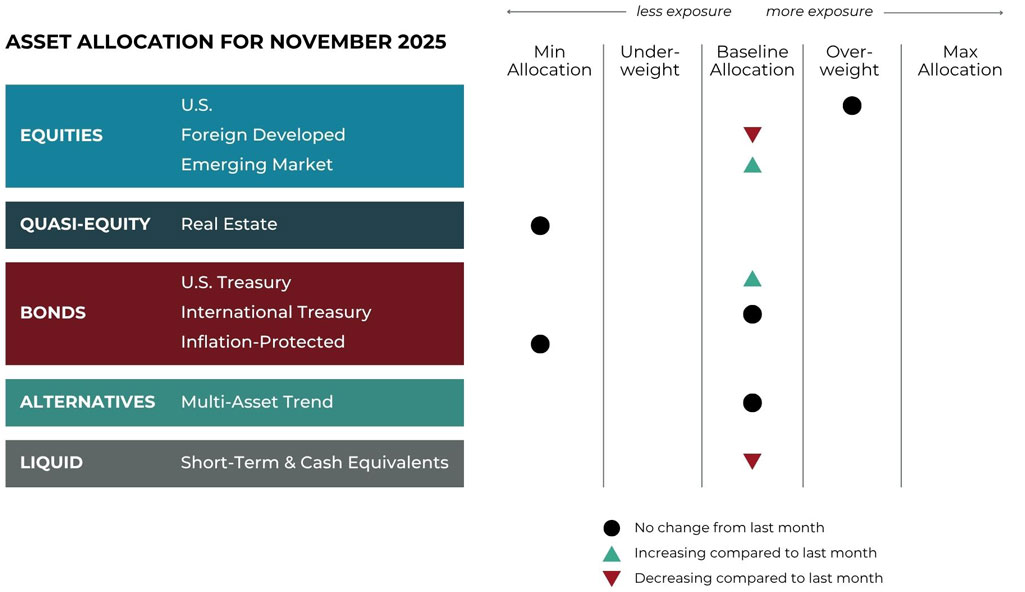

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for November.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Overall exposure will not change, with both foreign developed and emerging market equities coming into baseline allocation. Trends continue to be positive across all timeframes, and foreign developed will handoff some exposure back to strengthening emerging markets.

Real Estate

U.S. & International Treasuries

U.S. exposure will increase and move to baseline. Trends in the middle part of the U.S. Treasury yield curve are strongest and are now positive across all duration lengths. International Treasuries have weakened but are maintaining uptrends, and their overall allocation will remain at baseline.

Inflation-Protected Bonds

Exposure will be at its minimum. Trends are still positive but the group remains weak versus other fixed income assets.

Alternatives

Exposure is expressed through a multi-asset alternative ETF. Bond exposure remains the largest allocation, with net long exposure increasing during the month. Stocks remain the second-largest net allocation (long). Commodity exposure is net short, with longs in metals and shorts in grains keeping overall exposure balanced.

Short-Term Fixed Income

Asset-Level Overview

Equities & Real Estate

Coming out of a strong September, no one would have blamed stocks for taking a breather in October. And after starting the month sluggish, it appeared that would indeed be the case. However, after promising economic data and continued progress in trade talks with China, U.S. stocks once again climbed to new all time highs. Equities are on the verge of another positive month, the 6th consecutive for the S&P 500 Index.

For as strong as U.S stocks have been, foreign developed equities have been slightly better, also climbing to new highs using the FTSE Developed Markets Vanguard (VEA) as a guide. Similarly, emerging markets, namely China have benefitted from trade progress with the U.S. extending their gains for the year. For pure equity plays, the picture is clear and favorable as we head toward November.

With all this positivity in equities, one might expect real estate securities to also be doing well. And while the picture has improved, it remains murky. Trends are mixed to weakly positive, and prices remain mostly rangebound. In terms of absolute performance, real estate securities are below the major equity indexes for the year and many bond indexes as well.

Fixed Income & Alternatives

U.S. fixed income continues to build momentum and establish uptrends. Those price trends become less convincing as duration increases, but the short and middle portions of the yield curve have now established a compelling direction. For the first time in years, Treasury bond prices now have the potential to bring some value to portfolios.

International bonds continue to have uptrends, but they have materially weakened, particularly compared to the U.S.

Within the multi-asset trend alternatives bucket, short-term fixed income exposure decreased in favor of longs in higher-duration instruments, taking advantage of building uptrends. Net long commodity exposure fell despite increases to long exposure in metals, as short exposure to grains and livestock increased. Currency exposure was nearly unchanged, and net long exposure to stocks once again increased — albeit with an increase in valuable hedges on the short side.

3 Potential Catalysts For Trend Changes

Next Fed Cut: The Fed cut interest rates for the second straight meeting this month, but Chair Jerome Powell signaled no further reductions are expected before year-end. In his post-meeting press conference, Powell directly pushed back against bets on a December cut. The latest 25-basis-point move brings the federal funds rate to 3.75% to 4%, its lowest in three years and well below the prior high near 5.4%. The central bank will keep shrinking its portfolio of mortgage-backed securities and, starting in December, replace maturing bonds with short-term T-bills. Officials are now evaluating whether the recent softening in payroll growth reflects lower immigration and workforce participation or weakening labor demand.

Shutdown Limits: The federal government can typically sustain a shutdown for one month before significant operational challenges arise. During the 2018 shutdown, which lasted 35 days, operations resumed only after missed paychecks prompted air-traffic controllers to call in sick. In the current shutdown, now at the one-month mark, federal employees are missing paychecks, flight delays are increasing, and the government may soon be required to suspend benefits such as the Supplemental Nutrition Assistance Program (SNAP). The American Federation of Government Employees, the largest federal union, has joined other unions representing commercial pilots, the Teamsters, and additional local unions in expressing frustration with the ongoing shutdown. Transportation Secretary Sean Duffy reported that air-traffic controllers did not receive their full paychecks and identified 22 staffing shortages at control towers, resulting in 8,700 delayed flights. Treasury Secretary Scott Bessent stated that the government will be unable to fund military pay by mid-November. Several states have also issued warnings regarding the potential closure of Head Start programs.

Recent Grad Woes: Recent college graduates are experiencing increasing economic challenges. Although this group typically faces higher unemployment rates than older workers, the disparity has widened. In August, the overall unemployment rate was 4.3%, while the rate for recent graduates reached 6.5% during the preceding 12 months – the highest level in a decade except for the pandemic period. Economic disparities between parents and adult children illustrate a bifurcated economy that favors high earners and older individuals, while many others experience stagnation. The gap between high earners and younger or lower-income workers is expanding, even within families, contradicting traditional expectations that younger generations would achieve greater economic success than their predecessors.

Best Predictor of Asset Prices Is Often What They’re Doing Now

You take control of what you can control, so that the uncontrollable becomes more controllable.

—Tim Grover

After escaping the notoriously underperforming month of September and sidestepping any major increase in volatility for October, stocks are now poised for an above-average performance year for 2025.

With no national election this November, we expect the news cycle to continue to be about trade disputes and tariffs, inflation and interest rates, and international conflicts. Of course, this is only relevant for stocks to the extent you believe news drives markets and not the other way around.

Judging by daily movements of the S&P 500 Index, October was the most volatile month for stocks since April, when it was in the midst of its rapid recovery from the steep decline of late March and April. With that said, volatility remains historically low, and with another new all-time high reached in October, investors remain confident (and bullish) for now. Accordingly, our trend-based strategies remain unphased.

The direction of bond prices have also consistently been higher. Intermediate-length bonds of 3-10 years lead the way, their short-term counterparts also remain strong, and the long-term segment is weakest but emerging recently. Between the prevailing trends and comments by the Federal Reserve, it seems a general decline in interest rates is coming. The aforementioned move in stocks appears to also back that up.

We often say the best predictor of where asset prices will go in the short term is what they are doing now. Taken collectively, stock and bond prices seem to be pointing toward more of the same for now. As always, conditions can change quickly, but there is little indication a change is imminent.

As we approach the holiday season, we hope the calm holds so investors can more easily enjoy this time of family, food, and gratitude. The team at Bluegrass Capital Advisors is reminded of how much we have to be thankful for, from great colleagues to great clients and partners. It is sometimes difficult to step back and take stock of the many blessings we have, but let us all commit to doing so as we near the finish line of 2025.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead